The Single Tax

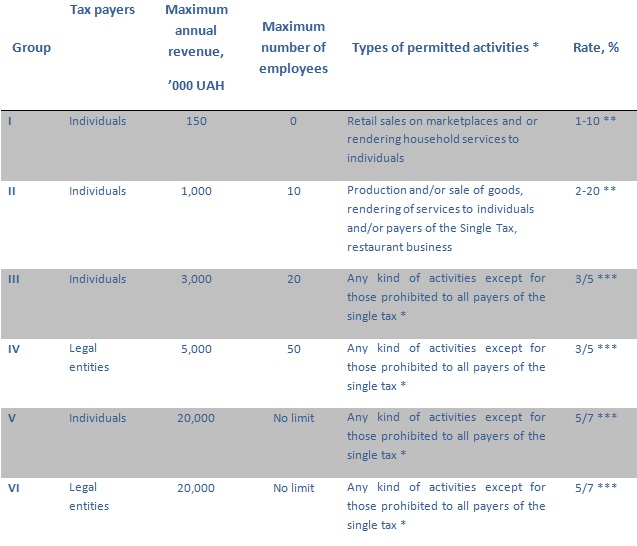

20.10.2013Classification of the ST payers, rates of tax and permitted kinds of business activities are described in the table below:

* Payers of the ST are prohibited to conduct the following types of business activities:

– organization of gambling;

– exchange of foreign currencies;

– production, export, import and sale of excisable goods;

– extraction, production and realization of precious metals and precious gems;

– extraction and realization of mineral resources;

– financial intermediation except of insurance;

– management of enterprises;

– postal and connection services;

– sales of pieces of art, antiques.

** Of minimum monthly salary set up as of January 1 of the reporting year

*** 3% (or 5% for groups V and VI) applies if VAT is been paid in accordance to the general rules; 5 (or 7)% is payable if VAT is included in the single tax and is not been paid separately.

Legal entities and individuals paying the Single Tax are exempt from the following taxes:

– Corporate Profits Tax

– Personal Income Tax (on income of individual entrepreneurs only)

– Value-Added Tax (except for payers opting for the ST rate at 6%)

– Land Tax

– Charge for conducting of certain kinds of entrepreneurial activities

– Charge for development of viticulture and hop growing.

Individual entrepreneurs who pay the ST shall pay the Single Social Charge accrued on their income, but not less than the minimum payment (minimum monthly wage multiplied by the rate of the charge).